In the dynamic and ever-evolving world of stock trading, the ability to interpret candlestick patterns is essential for success. Among these, the Upside Gap Two Crows Candlestick Pattern stands out as a key indicator for market trend reversals.

This comprehensive guide, crafted by expert market analysts, aims to provide an in-depth understanding of this pattern, instilling trust and excitement among traders and investors alike.

Understanding the Upside Gap Two Crows Candlestick Pattern

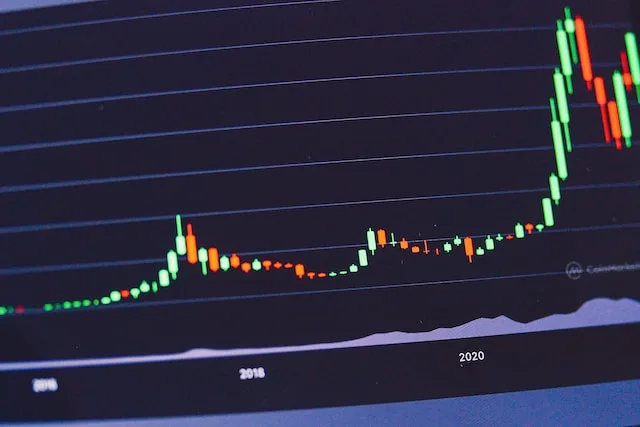

The Upside Gap Two Crows Candlestick Pattern is a bearish reversal indicator, often signaling a shift from bullish to bearish market sentiment. Although it’s a rare occurrence, its presence is highly regarded for its predictive accuracy. The pattern is characterized by three distinct candles:

- First Candle: A large white (or green) candle, signifying strong bullish momentum.

- Second Candle: A smaller black (or red) candle, opening with a gap above the previous day’s close.

- Third Candle: Another black candle, opening within the body of the second candle and closing within the body of the first candle.

Anatomy and Formation of the Upside Gap Two Crows Candlestick Pattern

The Upside Gap Two Crows Candlestick Pattern is a fascinating formation that captures a pivotal moment in the market’s narrative. It’s a story of shifting momentum and changing power dynamics between buyers and sellers. To fully grasp its significance, let’s break down the anatomy and formation of this pattern in detail.

- First Candle: The Initial Bullish Surge

- The pattern begins with a large white or green candle. This candle is crucial as it reflects a period of strong buying pressure. Investors are optimistic, driving prices up, and this candle typically closes near its high, signifying a robust bullish sentiment in the market.

- The size and volume of this candle are important. A larger candle with a high volume can indicate stronger buying interest and commitment from the bulls.

- Second Candle: The First Sign of Bearish Resistance

- The second day opens with a surprise for the market – a gap-up. This gap is where the pattern starts to intrigue. It initially appears as if the bullish trend is continuing, but then a smaller black or red candle forms.

- This candle doesn’t just fill the gap; it introduces a note of caution. The market opens at a higher price but closes lower than it opened, suggesting that the bearish sentiment is beginning to creep in. However, the second candle doesn’t encroach upon the territory of the first candle’s body, maintaining a distinct separation.

- Third Candle: The Bearish Turn

- The third candle is where the narrative takes a decisive turn. This candle opens within the body of the second candle but, crucially, closes within the body of the first. This is an unmistakable sign of bears gaining ground.

- The closing of this candle deep into the body of the first indicates that the bears are not just resisting but are actively pushing back the bullish advance. This is a significant moment as it suggests a shift from a dominant bullish sentiment to a growing bearish momentum.

- The third candle’s ability to close within the first candle’s body is a key aspect. It demonstrates that the bears have managed to overrun the bulls’ previous session gains, marking a potential trend reversal.

Implications of the Pattern Formation

- The Upside Gap Two Crows pattern is not just a random occurrence; it’s a narrative of market sentiment shifting from optimism to caution and potentially to pessimism.

- This pattern warns traders and investors that the bullish trend might be losing steam and that a bearish trend could be on the horizon.

- It’s crucial to observe the pattern in the context of the prevailing market trend and other technical indicators. Its occurrence at the peak of an uptrend can be a stronger signal compared to its appearance during a sideways or fluctuating market.

Integrating the Pattern into Trading Strategies

Understanding the Upside Gap Two Crows pattern is a critical first step, but integrating this knowledge into a broader trading strategy is what sets successful traders apart. Here are key ways to effectively incorporate this pattern into trading decisions:

- Combining with Other Technical Indicators:

- Moving Averages: Utilize moving averages to gauge the overall trend. If the Upside Gap Two Crows pattern forms when the price is below a major moving average (like the 50-day or 200-day), it may reinforce the bearish reversal signal.

- Relative Strength Index (RSI) and Stochastic Oscillator: These momentum indicators can help confirm the reversal signal. An overbought condition (RSI above 70, for example) alongside the Upside Gap Two Crows may suggest a higher likelihood of a bearish reversal.

- Volume Analysis: High trading volume on the third candle of the pattern can validate the strength of the bearish sentiment. Conversely, low volume might suggest a weaker reversal signal.

- Contextual Market Analysis:

- Analyze the market context in which the pattern appears. A bearish reversal pattern like this one is more significant at the end of a prolonged uptrend or near resistance levels.

- Take into account the overall mood of the market and key economic indicators. The pattern might have different implications in a bull market compared to a bear or volatile market.

- Risk Management:

- When trading based on this pattern, set stop-loss orders above the high of the first candle or the gap. This helps manage the risk in case the anticipated bearish reversal does not materialize.

- Adjust position sizes according to the confidence level in the pattern’s formation and the accompanying market conditions.

Advanced Technical Considerations

For traders aiming to refine their technical analysis skills, understanding the nuanced applications of the Upside Gap Two Crows pattern is key. Here are some advanced considerations:

- Volume Analysis and Pattern Strength:

- Investigate the trading volume during the formation of the pattern. An increase in volume, especially on the third candle, can indicate a stronger bearish sentiment.

- In contrast, a pattern formed on low volume might not be as reliable and could require additional confirmation from other indicators.

- Sector-Specific Behavior:

- Different market sectors may respond differently to this pattern. For instance, in highly volatile sectors like technology, the pattern might indicate a more significant reversal than in more stable sectors like utilities.

- Understanding sector-specific dynamics can enhance the application of this pattern in diversified portfolios.

- Correlation with Other Technical Indicators:

- Look for confluence with other technical indicators such as Fibonacci retracement levels, Bollinger Bands, or chart patterns like head and shoulders.

- The combination of the Upside Gap Two Crows pattern with other bearish indicators can create a stronger case for a potential downward move.

- Backtesting and Historical Performance:

- Backtesting the pattern across different time frames and market conditions can provide insights into its reliability and effectiveness.

- Historical performance analysis helps traders understand the probability of successful outcomes when trading based on this pattern.

Psychological Aspects and Market Sentiment

The psychological aspect of trading is often as crucial as the technical side. This section explores how the Upside Gap Two Crows candlestick pattern reflects underlying market sentiment and trader psychology, offering insights into the behavioral aspects of market participants.

Risk Management and Strategic Planning

Incorporating the Upside Gap Two Crows candlestick pattern into strategic planning and risk management is vital for long-term trading success. Here, we discuss how to use this pattern as part of a diversified trading plan, emphasizing risk management techniques and long-term strategy considerations.

Frequently Asked Questions

How does the Upside Gap Two Crows candlestick pattern differ from other bearish reversal patterns?

This section will compare the Upside Gap Two Crows candlestick pattern with other bearish reversal patterns, highlighting its unique characteristics and usage in different trading scenarios.

How can beginners in trading learn to effectively identify and use the Upside Gap Two Crows candlestick pattern?

This question will address the learning curve for beginners and provide tips on how they can familiarize themselves with this pattern and other technical analysis tools.

Are there any specific sectors or stocks where this pattern is more prevalent?

Here, we will discuss if the Upside Gap Two Crows candlestick pattern has any sector-specific relevance and how it behaves in different stock categories.

Closing Thoughts and Key Takeaways

In conclusion, the Upside Gap Two Crows Candlestick Pattern is more than just a chart formation; it’s a lens through which market sentiments and trends can be understood and predicted. This comprehensive guide aims to equip traders with the knowledge and tools to use this pattern effectively in their trading endeavors.

For those seeking further knowledge and insights, [The Market Technicians] offers a wealth of educational content, emphasizing that continuous learning and adaptability are key in the ever-changing world of stock trading.

Disclaimer: Trading carries inherent risks, and previous performance does not guarantee future outcomes. The content presented in this article is solely for educational purposes and should not be construed as financial counsel. We strongly recommend consulting a certified financial expert before initiating any trading activities.

Note: The material within this article is provided for informational purposes exclusively and should not be seen as a replacement for expert financial guidance. Whenever you have inquiries concerning your investments or trading methods, always seek the guidance of a qualified financial advisor.

Affiliate link disclaimer: Some links in this article may earn us a commission for any resulting purchases. Thank you for supporting our content.

daxktilogibigibi.ePl1gDetMmQt

Wohh just what I was searching for, regards for posting.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I simply wished to say thanks all over again. I am not sure the things I could possibly have worked on without those points documented by you about such theme. It became a very difficult case for me, nevertheless coming across this expert mode you resolved that forced me to jump with gladness. Now i’m happy for this support and even hope you find out what a great job you are getting into training some other people by way of your blog post. Most probably you’ve never encountered any of us.