As a trader, it’s crucial to have a diverse toolkit of strategies and techniques to identify profitable trading opportunities. One such tool that has gained popularity among traders is the stars candlestick patterns.

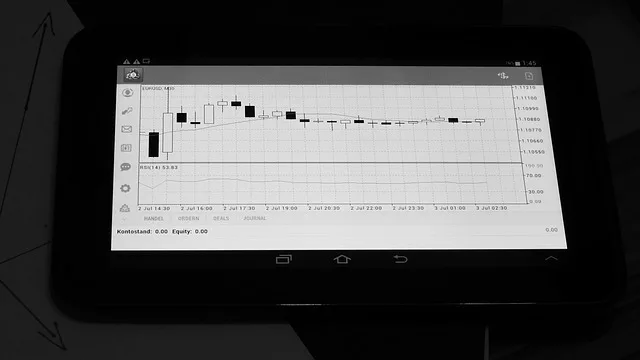

Candlestick patterns are visual representations of price movements in the form of candles, and stars candlestick patterns are particularly known for their ability to signal potential reversals or continuations in price trends.

In this article, we will delve deeper into stars candlestick patterns, their types, how to identify them, and how to use them in trading strategies to improve your chances of success.

- Understanding Stars Candlestick Patterns

- Morning Star

- Evening Star

- Doji Star

- Shooting Star

- How to Identify Stars Candlestick Patterns

- Trading Strategies Using Stars Candlestick Patterns

- Morning Star Strategy:

- Evening Star Strategy:

- Doji Star Strategy:

- Shooting Star Strategy:

- Combination Strategies:

- Tips for Trading with Stars Candlestick Patterns

- Conclusion

- Frequently Asked Questions (FAQs)

Understanding Stars Candlestick Patterns

Stars candlestick patterns are formed when a small candle, called the “star,” appears within the body of a larger candle. The star candle typically has a small real body and long shadows, which makes it stand out from the surrounding candles.

Stars patterns can indicate potential trend reversals or continuations depending on their position in the price chart. These patterns can indicate potential trend reversals or continuations depending on their position in the price chart.

Stars candlestick patterns are categorized into four main types: the morning star, the evening star, the doji star, and the shooting star.

Morning Star

The morning star is a bullish reversal pattern that occurs after a downtrend. It consists of three candles: a long bearish candle, followed by a small bullish or bearish doji or spinning top, and then a long bullish candle.

The morning star pattern suggests that the bears are losing control and that a bullish trend may be starting.

Evening Star

The evening star is the opposite of the morning star and is a bearish reversal pattern that occurs after an uptrend. It also consists of three candles: a long bullish candle, followed by a small bullish or bearish doji or spinning top, and then a long bearish candle.

The evening star pattern indicates that the bulls are losing momentum and that a bearish trend may be imminent.

Doji Star

The doji star is a neutral pattern that can act as both a reversal and a continuation pattern. It occurs when a doji candle, which has a small real body and long shadows, appears within the body of a larger candle.

The doji star suggests indecision in the market and can signal a potential reversal or continuation depending on the context of the price chart.

Shooting Star

The shooting star pattern is one of the most recognizable stars candlestick patterns and is known for its potential bearish reversal signal. It forms after an uptrend and is identified by a small real body (usually red or black) with a long upper shadow, and little to no lower shadow.

The long upper shadow suggests that bulls pushed the price higher during the session, but bears regained control, pushing the price lower by the session’s close.

How to Identify Stars Candlestick Patterns

Identifying stars candlestick patterns requires a keen eye for detail and a good understanding of the market context. Here are some key steps to identify these patterns effectively:

- Look for the pattern: Scan your price chart for potential morning star, evening star, or doji star patterns. Pay attention to the shape and size of the candles, as well as their position in the price chart.

- Confirm the trend: Stars candlestick patterns are most effective when they occur after a strong trend. Confirm the trend direction using trend lines, moving averages, or other technical indicators. Morning stars occur after a downtrend, evening stars occur after an uptrend, and doji stars can occur in both uptrends and downtrends.

- Check the confirmation factors: Stars candlestick patterns are not standalone signals and require confirmation from other technical indicators or price patterns. Look for confirmation factors, such as trend lines, support and resistance levels, Fibonacci retracement levels, or other candlestick patterns, to validate the signals provided by stars candlestick patterns.

- Consider the timeframe: Stars candlestick patterns can have different implications depending on the timeframe you are trading. A morning star pattern on a daily chart may have a different significance than the same pattern on a 5-minute chart. Consider the timeframe you are trading and look for confirmation from other timeframes to increase the reliability of the signals.

- Practice and backtest: Like any other trading strategy, mastering stars candlestick patterns requires practice and backtesting. Keep a trading journal to record your observations and results, and use historical price data to backtest the patterns on different timeframes and market conditions to gain confidence in their effectiveness.

Trading Strategies Using Stars Candlestick Patterns

Morning Star Strategy:

When a morning star pattern forms after a downtrend, it can be a signal to enter a long position. Traders can place a buy order above the high of the third bullish candle, with a stop-loss order below the low of the first bearish candle.

They can also use confirmation factors, such as a break above a trend line or a moving average crossover, to increase the probability of a successful trade.

Evening Star Strategy:

When an evening star pattern forms after an uptrend, it can be a signal to enter a short position or exit a long position. Traders can place a sell order below the low of the third bearish candle, with a stop-loss order above the high of the first bullish candle.

Confirmation factors, such as a break below a support level or a bearish divergence on an oscillator, can be used to confirm the trade.

Doji Star Strategy:

When a doji star pattern forms, traders can use it as a signal to watch for potential trend reversals or continuations. They can place buy or sell orders depending on the direction of the breakout from the doji candle, with stop-loss orders placed accordingly.

Confirmation factors, such as a break above or below a trend line or a key support/resistance level, can be used to validate the trade.

Shooting Star Strategy:

When a shooting star pattern forms, traders can use it as a signal to watch for potential trend reversals. They can place sell orders or short positions, depending on the confirmation of the pattern, with stop-loss orders placed accordingly.

Confirmation factors, such as a break below a trend line or a key support level, can be used to validate the trade.

Combination Strategies:

Traders can also combine stars candlestick patterns with other technical indicators or price patterns to increase the accuracy of their trades.

For example, they can use stars candlestick patterns in conjunction with trend lines, moving averages, Fibonacci retracement levels, or other candlestick patterns to confirm the signals and identify high-probability trading opportunities.

Tips for Trading with Stars Candlestick Patterns

Here are some tips to keep in mind when using stars patterns in your trading strategy:

- Use proper risk management: As with any trading strategy, it’s crucial to manage your risk effectively. Place stop-loss orders to limit your losses in case the trade goes against you, and use proper position sizing to ensure that you are not risking more than you can afford to lose.

- Confirm signals with other factors: Stars candlestick patterns are not standalone signals and should be confirmed with other technical indicators or price patterns. Look for confirmation factors, such as trend lines, support and resistance levels, and other candlestick patterns, to validate the signals provided by stars candlestick patterns.

- Consider the overall market context: Stars candlestick patterns should be interpreted in the context of the overall market trend and market conditions. Consider the trend direction, volatility, and other relevant factors to make informed trading decisions.

- Backtest and practice: Practice identifying stars candlestick patterns on historical price data and backtest your trading strategy using these patterns. Keep a trading journal to record your observations and results, and continuously refine your strategy based on your findings.

- Stay disciplined and patient: Trading with stars candlestick patterns requires discipline and patience. Wait for the pattern to fully form and confirm before entering a trade, and stick to your trading plan and risk management rules.

Conclusion

Stars candlestick patterns can be valuable tools for traders to identify potential trend reversals or continuations in the markets. By understanding the different types of stars candlestick patterns, how to identify them, and how to use them in trading strategies, traders can enhance their technical analysis skills and make informed trading decisions.

However, it’s important to remember that no trading strategy is foolproof, and risk management should always be a top priority in any trading endeavor. Always use stars candlestick patterns in conjunction with other technical indicators and confirmatory factors to increase the accuracy of your trades.

In conclusion, stars candlestick patterns are a powerful tool in technical analysis that can provide valuable insights into market sentiment and potential price movements. By incorporating them into your trading strategy, along with proper risk management and confirmation from other factors, you can improve your trading skills and increase your chances of success in the markets.

For more trading literature, insights, and news, be sure to check out “The Market Technicians” website for additional resources.”

Frequently Asked Questions (FAQs)

Can stars patterns be used in any market or timeframe?

Yes, stars candlestick patterns can be used in any market, including stocks, forex, commodities, and cryptocurrencies, and in any timeframe, including intraday, daily, weekly, and monthly charts.

How reliable are stars candlestick patterns as trading signals?

While stars candlesticks can provide valuable insights into potential trend reversals or continuations, they are not foolproof and should be confirmed with other technical indicators and factors. It’s important to practice and backtest your trading strategy using stars candlestick patterns to determine their effectiveness in your specific trading style and market conditions.

What are some common confirmation factors that can be used with stars candlesticks?

Some common confirmation factors that can be used with stars candlestick patterns include trend lines, support and resistance levels, moving averages, Fibonacci retracement levels, and other candlestick patterns. These factors can help validate the signals provided by stars candlestick patterns and increase the accuracy of your trades.

How important is risk management when trading with stars candlestick patterns?

Risk management is crucial in any trading strategy, including when using stars candlestick patterns. Always place stop-loss orders to limit your losses and use proper position sizing to ensure that you are not risking more than you can afford to lose. Remember to stay disciplined and follow your risk management rules at all times.

Can stars candlestick patterns be used as standalone trading signals?

Stars patterns should not be used as standalone trading signals and should be confirmed with other technical indicators and factors. They are best used in conjunction with a comprehensive trading plan and a disciplined approach to trading.

Affiliate link disclaimer: Some links in this article may earn us a commission for any resulting purchases. Thank you for supporting our content.

Add a Comment