The world of trading is filled with various indicators and patterns, each offering unique insights into market trends and potential movements. Among these, the Three Advancing White Soldiers Candlestick Pattern stands out as a particularly powerful tool in technical analysis. This article, penned by a seasoned market analyst with over a decade of experience in financial markets, aims to provide an in-depth understanding of this pattern, highlighting its significance, application, and impact on trading decisions.

Understanding the Basics

What is the Three Advancing White Soldiers Candlestick Pattern?

The Three Advancing White Soldiers is a bullish candlestick pattern that typically emerges at the end of a downtrend, signaling a strong reversal. It consists of three consecutive long-bodied candlesticks, each closing higher than the previous one, and opening within the body of the preceding candlestick. This pattern is widely recognized as a reliable indicator of a shift in market momentum from bearish to bullish.

Historical Context and Origin

The pattern’s origins trace back to the early days of Japanese rice trading, where candlestick charting techniques were first developed. Over the centuries, these techniques have been refined and have become integral to technical analysis in various financial markets, including stock, forex, and commodities.

Anatomy of the Pattern

Detailed Description of Each Candlestick

- First Soldier: The appearance of the first long white (or green in modern charting software) candlestick marks the beginning of the reversal. It typically emerges after a period of bearish sentiment, indicating a newfound bullish strength.

- Second Soldier: The second candlestick, also long and white, opens within the range of the first candlestick’s body and closes higher. This reinforces the bullish trend, suggesting growing confidence among buyers.

- Third Soldier: The final candlestick confirms the bullish takeover. It follows the same criteria as the second, solidifying the reversal pattern and indicating sustained buying pressure.

Key Characteristics and Variations

While the basic structure of the pattern is straightforward, certain variations can occur. These variations might include slight differences in the size of the candlesticks or small gaps between them. However, the essence of the pattern remains the same: a decisive shift towards bullish sentiment.

Application and Interpretation

Real-World Examples and Case Studies

Several case studies illustrate the efficacy of the Three Advancing White Soldiers pattern in predicting market reversals. For instance, in the stock market, the emergence of this pattern in a downtrending blue-chip stock often preludes a significant uptrend, offering a lucrative opportunity for traders.

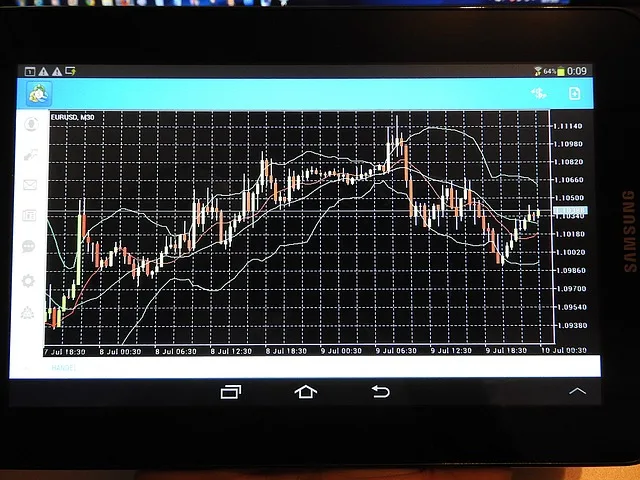

Combining with Other Technical Indicators

While the pattern is powerful, it is most effective when used in conjunction with other technical indicators, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). This multi-faceted approach allows for a more comprehensive market analysis and reduces the risk of false signals.

Best Practices and Strategy

When to Enter and Exit Trades

Identifying the pattern is just the first step. Traders need to strategically decide when to enter and exit trades. A common approach is to enter a trade after the confirmation of the third soldier and set a stop loss below the pattern’s lowest point to manage risk.

Risk Management Considerations

Risk management is crucial when trading with the Three Advancing White Soldiers pattern. Traders should always consider the overall market conditions, the specific asset’s volatility, and their risk tolerance before entering a trade.

Limitations and Pitfalls

Recognizing False Signals

Like all technical patterns, the Three Advancing White Soldiers is not infallible. False signals can occur, especially in highly volatile markets or when the pattern forms without a significant preceding downtrend.

Market Context and Environmental Factors

The effectiveness of the pattern can also be influenced by broader market conditions and economic factors. Traders need to stay informed about global economic trends, news events, and sector-specific developments.

Frequently Asked Questions

How reliable is the Three Advancing White Soldiers pattern in predicting bullish reversals?

While it is a strong indicator, its reliability increases when combined with other technical analysis tools and market context considerations.

Is this pattern suitable for novice traders?

Yes, it can be a valuable tool for traders of all levels, provided they invest time in understanding and practicing its application.

Can the pattern be applied in all financial markets?

It’s applicable across various markets, including stocks, forex, and commodities.

How does one differentiate between a true pattern and a false signal?

A true pattern typically follows a clear downtrend and is confirmed by additional technical indicators. False signals may occur in less clear contexts or during market instability.

What should be considered before making a trade based on this pattern?

Consider overall market trends, the specific asset’s history, accompanying volume data, and other technical indicators for a comprehensive analysis.

Conclusion

The Three Advancing White Soldiers Candlestick Pattern is a valuable tool in a trader’s arsenal, offering insights into potential market reversals. By understanding and applying this pattern strategically, traders can enhance their decision-making processes and potentially increase their success in the markets. Remember, continuous learning and adaptation are key in the ever-evolving world of trading.

For more comprehensive insights and detailed market analysis, traders can turn to [The Market Technicians]. As an educational platform, we are dedicated to providing in-depth knowledge and resources, empowering traders to navigate the markets with confidence. Remember, our goal is to educate and inform, not to offer direct trading services.

Affiliate link disclaimer: Some links in this article may earn us a commission for any resulting purchases. Thank you for supporting our content.

daxktilogibigibi.HO3hFvxP37is

Wow, marvelous blog layout! How lengthy have you ever been running a blog for?

you make blogging look easy. The total look of your website is excellent,

let alone the content! You can see similar:

sklep online and here najlepszy sklep

Wow, awesome blog layout! How lengthy have you ever been blogging for?

you make blogging look easy. The whole glance of your web site is wonderful, let alone the content!

You can see similar here sklep online

Some truly nice and useful information on this website, likewise I believe the style has excellent features.

I have been absent for a while, but now I remember why I used to love this site. Thank you, I will try and check back more often. How frequently you update your web site?

wonderful points altogether, you just won a emblem new reader. What may you suggest about your post that you made a few days ago? Any sure?

Just wish to say your article is as surprising. The clearness in your post is just cool and i can assume you are an expert on this subject. Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please keep up the enjoyable work.