In the dynamic world of financial markets, the ability to interpret and leverage candlestick patterns can significantly enhance a trader’s strategy. Among these, High-Price and Low-Price Gapping Play Candles stand out as powerful tools. This article, penned by a seasoned market technician with years of hands-on experience, aims to demystify these patterns and provide you with a clear, authoritative guide on how to use them effectively.

Understanding the Anatomy of Gapping Play Candles

What are High-Price and Low-Price Gapping Play Candles?

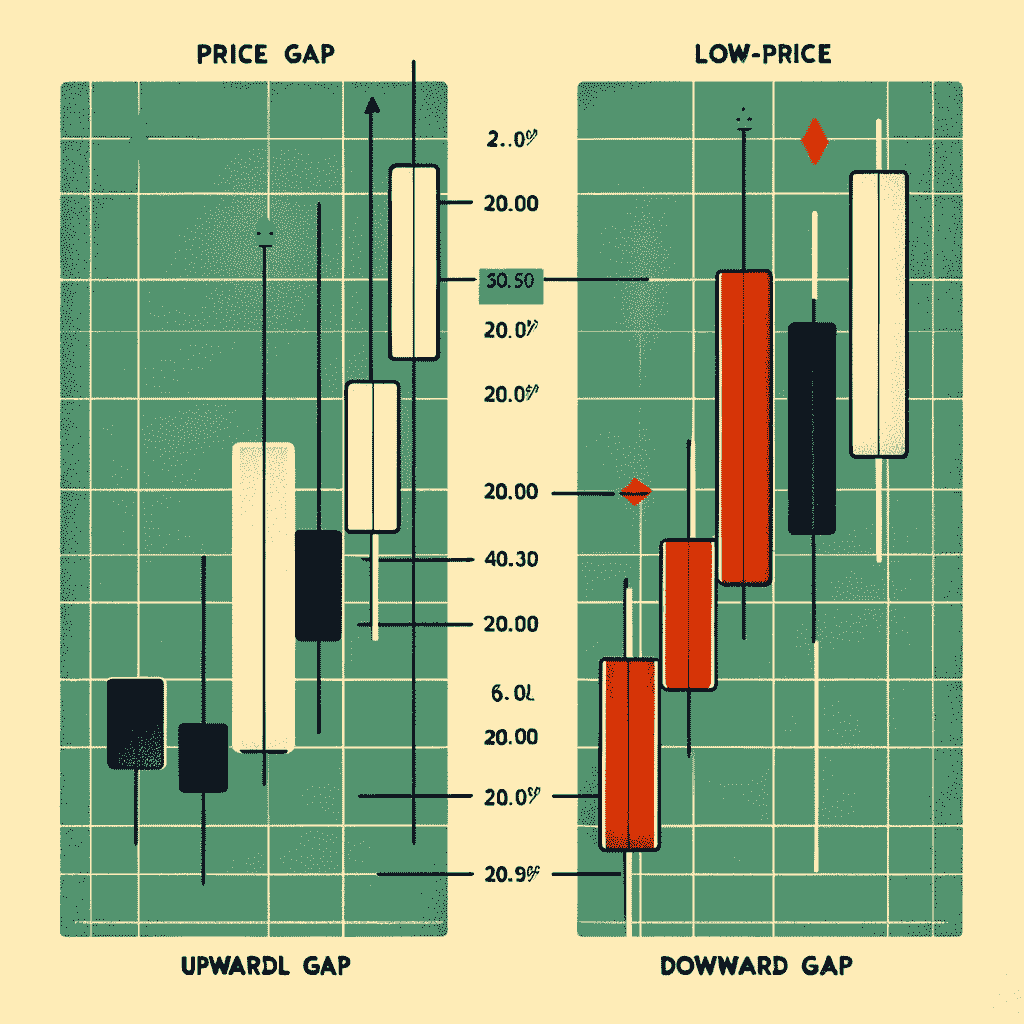

High-Price and Low-Price Gapping Play Candles are unique patterns observed in candlestick charts, widely used in technical analysis. These patterns occur when the market experiences a significant gap in price movement, typically driven by strong market sentiments or news events.

High-Price Gapping Play: This pattern forms when a security’s price gaps up from the previous day’s high, indicating a strong buying interest.

Low-Price Gapping Play: Conversely, this pattern appears when the price gaps are down from the previous day’s low, signaling strong selling pressure.

Anatomy of Gapping Play Candles

The key characteristics of these patterns include a gap in the price and a significant difference between the opening and closing prices of the trading session. The size and position of the gap provide valuable insights into market momentum and potential future movements.

The Significance of Gapping Play Candles in Market Analysis

Gapping Play Candles are not just random occurrences; they are indicative of underlying market forces. In high-price gapping plays, the gap suggests that buyers are willing to pay a premium over the previous day’s high, reflecting strong bullish sentiment. Conversely, in low-price gapping plays, the gap indicates sellers’ urgency to exit, signifying bearish sentiment.

Strategic Implementation

Incorporating High-Price and Low-Price Gapping Play Candles into your trading strategy requires a nuanced approach. It’s not just about identifying the pattern but understanding the context in which it appears. Factors such as market trends, volume, and accompanying indicators should be considered to gauge the strength of the signal.

Case Studies

Imagine a scenario where a High-Price gaming play is identified in a bullish market. This might indicate a sustained rise in the upward trend. However, if the same pattern appears in a bearish market, it could indicate a potential reversal. Traders should analyze these patterns within the broader market context to make informed decisions.

Risk Management

While gapping play candles can be indicative of significant moves, they are not without risk. It is essential to implement sound risk management strategies, such as setting stop-loss orders, to safeguard against unexpected market reversals.

The Role of Gapping Play Candles in Portfolio Diversification

Diversification is a key strategy in managing investment risk. High-Price and Low-Price Gapping Play Candles can be used to identify entry and exit points in various market segments, aiding in the creation of a diversified portfolio.

Frequently Asked Questions

How can I identify High-Price and Low-Price Gapping Play Candles?

Look for a significant gap in the price movement compared to the previous session’s high or low. The gap, coupled with a large candle body, is a key identifier.

Are these patterns reliable indicators of future price movements?

While no pattern guarantees future price movements, Gapping Play Candles, when combined with other analysis tools, can significantly enhance prediction accuracy.

Can these patterns be applied in all markets?

Yes, these patterns are applicable across various markets, including stocks, forex, and commodities.

How often do these patterns occur in the market?

The frequency of High-Price and Low-Price Gapping Play Candles can vary depending on market conditions. They are more common in volatile markets or around major news events.

Can these patterns be used in short-term trading?

Yes, these patterns can be effectively used in both short-term and long-term trading strategies, depending on your trading style and objectives.

Enhancing Your Trading Skills with [The Market Technicians]

Our website offers extensive resources and educational materials to help you refine your trading strategies using candlestick patterns like High-Price and Low-Price Gapping Play Candles. Whether you’re a novice or an experienced trader, our content is designed to enhance your market literacy and trading proficiency.

Conclusion

In conclusion, High-Price and Low-Price Gapping Play Candles are invaluable tools in the trader’s toolkit. Their ability to signal significant market movements makes them crucial for effective trading strategies. By understanding their formation and implications, traders can better navigate the complexities of the financial markets. For further insights and advanced strategies, we encourage you to explore the resources available at [The Market Technicians]. Remember, our goal is to empower you with knowledge, not to provide trading services. Embrace the journey of learning and let your trading skills flourish!

Disclaimer: Trading carries inherent risks, and previous performance does not guarantee future outcomes. The content presented in this article is solely for educational purposes and should not be construed as financial counsel. We strongly recommend consulting a certified financial expert before initiating any trading activities.

Note: The material within this article is provided for informational purposes exclusively and should not be seen as a replacement for expert financial guidance. Whenever you have inquiries concerning your investments or trading methods, always seek the guidance of a qualified financial advisor.

Affiliate link disclaimer: Some links in this article may earn us a commission for any resulting purchases. Thank you for supporting our content.

You made some really good points there. I looked on the web to learn more about

the issue and found most individuals will go along with your views on this site.

Wow, incredible blog format! How lengthy have you ever been blogging for?

you make blogging glance easy. The full look of your site is magnificent,

let alone the content material! You can see similar:

sklep online and here e-commerce

Wow, marvelous weblog layout! How long have you been running a

blog for? you made running a blog glance easy.

The entire glance of your website is magnificent,

as neatly as the content! You can see similar: sklep online and here najlepszy sklep

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Wow, marvelous weblog layout! How lengthy have you

been running a blog for? you made blogging glance easy.

The overall glance of your site is great, let alone the content material!

You can see similar here sklep internetowy

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

I have recently started a website, the info you offer on this site has helped me tremendously. Thanks for all of your time & work.

Thank you, I’ve just been searching for info about this subject for ages and yours is the best I’ve discovered so far. But, what about the bottom line? Are you sure about the source?