In the dynamic world of trading, understanding candlestick patterns is crucial for success. One such pattern, the Window Candlestick Pattern, stands out for its reliability and the deep insights it offers into market psychology. In this article, we will delve into the anatomy, formation, and practical applications of the Window Candlestick Pattern, ensuring you have a well-rounded understanding of this essential trading tool.

What is the Window Candlestick Pattern?

The Window Candlestick Pattern, often seen as a beacon in the tumultuous sea of market data, represents a significant gap in the price movement of a security, commodity, or index. It typically indicates a strong buying or selling pressure and can be a precursor to significant market moves.

Understanding the Anatomy of the Pattern

Formation and Interpretation

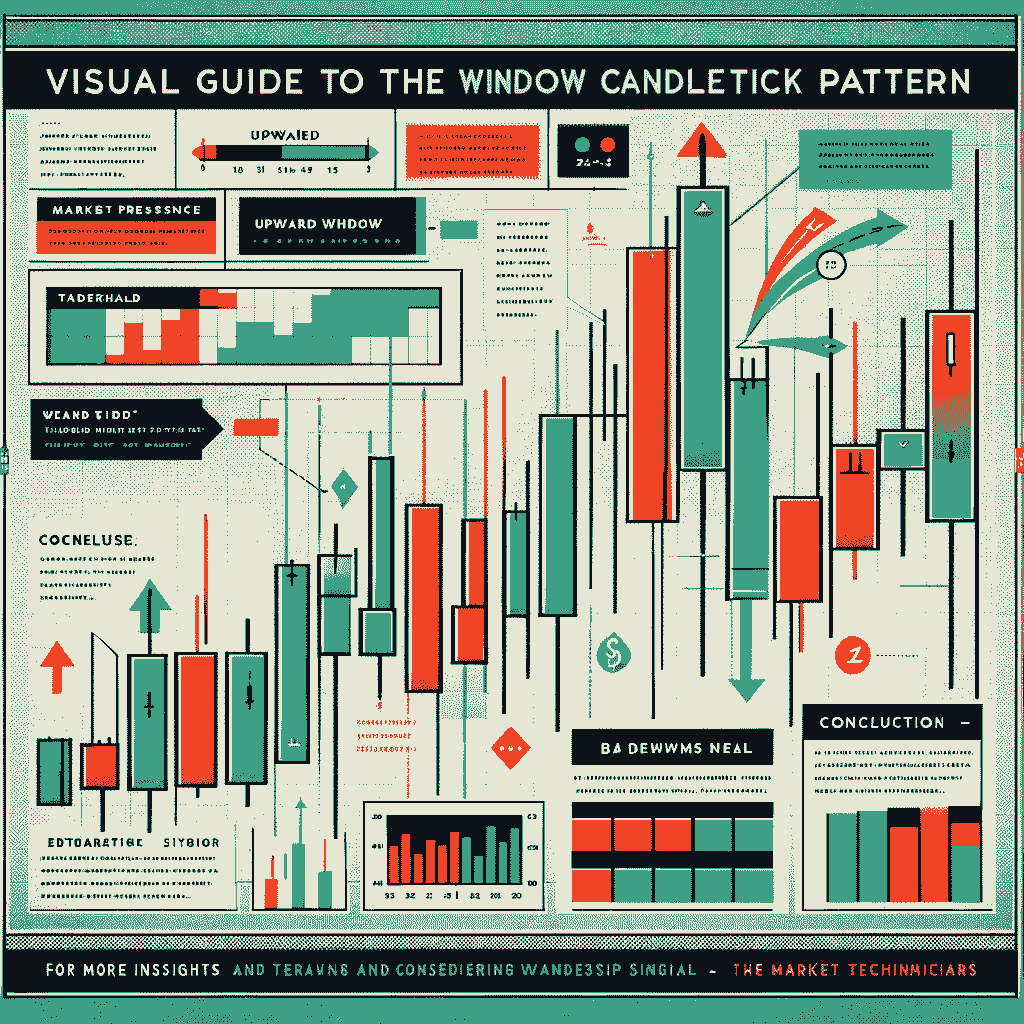

The formation of the Window Pattern occurs when there is a noticeable gap between the closing price of one session and the opening price of the next. This gap, or ‘window’, can be either upward or downward. An upward window suggests bullish sentiment, while a downward window indicates bearish sentiment.

Types of Window Patterns:

- Bullish Windows: These occur during an uptrend and are seen as a sign of continued bullish sentiment.

- Bearish Windows: Found during a downtrend, these indicate ongoing bearish sentiment.

How to Identify and Interpret

Identifying a window pattern requires keen observation. A bullish window, for instance, appears when the low price of the current candlestick is higher than the high price of the preceding one. Conversely, a bearish window forms when the high price of the current candlestick is lower than the low price of the preceding one.

Trust and Excitement

Building Confidence in Trading Decisions

Understanding the Window Candlestick Pattern equips traders with a powerful tool for making informed decisions. It’s not just about recognizing the pattern; it’s about understanding the market sentiments driving it.

Embracing the Window Candlestick Pattern

Trading Strategies Involving the Window Pattern

- Entry Points: Traders often use bullish windows as entry points for long positions, expecting the uptrend to continue. Similarly, bearish windows can signal an opportune moment to enter a short position.

- Exit Points: A window pattern can also serve as a cue for exiting positions. If you’re in a long position and a bearish window appears, it might be time to consider selling to avoid potential losses.

- Stop-Loss Orders: Incorporating window patterns into stop-loss strategies can help mitigate risk. For example, placing a stop-loss order just below a bullish window can protect profits in an uptrend.

Advanced Strategies with the Window Candlestick Pattern

Beyond its basic interpretation, the Window Candlestick Pattern can be integrated into more advanced trading strategies. For instance, traders might look for confluence with other technical indicators such as moving averages or RSI (Relative Strength Index) to reinforce the signal provided by the window. This multi-faceted approach can significantly enhance the reliability of your trading decisions.

Risk Management Considerations

While the Window Pattern offers valuable insights, it is crucial to pair it with sound risk management strategies. This includes setting appropriate stop-loss orders to protect against unexpected market reversals. Understanding the pattern’s implications helps traders not only in identifying opportunities but also in managing potential risks.

The Role of Market Context

The effectiveness of the Window Candlestick Pattern also depends on the broader market context. For example, a window occurring in a strong uptrend may have different implications than one appearing in a downtrend. Traders should always consider the overall market environment before making decisions based on this pattern.

FAQs on Window Pattern

How reliable is the Window Candlestick Pattern?

While no pattern is infallible, the Window Candlestick Pattern is considered highly reliable when combined with other technical indicators.

Can this pattern be used for all types of trading?

Absolutely. Whether you’re into day trading, swing trading, or long-term investing, this pattern can provide valuable insights.

How does one differentiate between a true window and a mere price fluctuation?

True windows are characterized by a significant gap in price, often accompanied by high trading volumes.

What time frames does the Window Pattern work best on?

This pattern is versatile and can be identified on various time frames, from intraday charts to weekly or monthly charts, depending on your trading style.

Is the Window Candlestick Pattern suitable for beginners?

Yes, it’s a great starting point for beginners due to its relative simplicity and clear signals.

Can the Window Pattern be applied to different markets?

Absolutely, it’s applicable across various markets including stocks, forex, commodities, and more.

Final Thoughts: Mastering the Window Candlestick Pattern

In conclusion, the Window Pattern is more than just another chart pattern; it’s a critical tool in a trader’s arsenal. By understanding its nuances and applying it in the right market context, you can significantly enhance your trading strategy. Remember, continuous learning and adapting are key to success in the ever-evolving world of trading.

For more in-depth analysis and educational resources, visit “The Market Technicians“. Here, you’ll find a treasure trove of information that will support your journey towards becoming a more skilled and confident trader. The Window Candlestick Pattern is just the beginning of a fascinating journey into the world of technical analysis. Let it be the light that guides you to trading excellence.

Disclaimer: Trading carries inherent risks, and previous performance does not guarantee future outcomes. The content presented in this article is solely for educational purposes and should not be construed as financial counsel. We strongly recommend consulting a certified financial expert before initiating any trading activities.

Note: The material within this article is provided for informational purposes exclusively and should not be seen as a replacement for expert financial guidance. Whenever you have inquiries concerning your investments or trading methods, always seek the guidance of a qualified financial advisor.

Affiliate link disclaimer: Some links in this article may earn us a commission for any resulting purchases. Thank you for supporting our content.

[url=http://mockwa.com/forum/thread-141318/]http://mockwa.com/forum/thread-141318/[/url]

Wow, incredible blog structure! How lengthy have you been blogging for?

you made blogging glance easy. The overall look of your web site is magnificent, as well as

the content material! You can see similar here sklep

I’m truly enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Outstanding work!

I’ve been exploring for a little bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this website. Reading this information So i’m satisfied to express that I’ve a very excellent uncanny feeling I discovered exactly what I needed. I so much indubitably will make sure to don’t omit this web site and provides it a glance on a constant basis.

I think this is among the most important info for me. And i’m glad reading your article. But wanna remark on some general things, The web site style is ideal, the articles is really great : D. Good job, cheers

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.